India's Startup Funding Surges: April Sees 15% Month-on-Month Increase

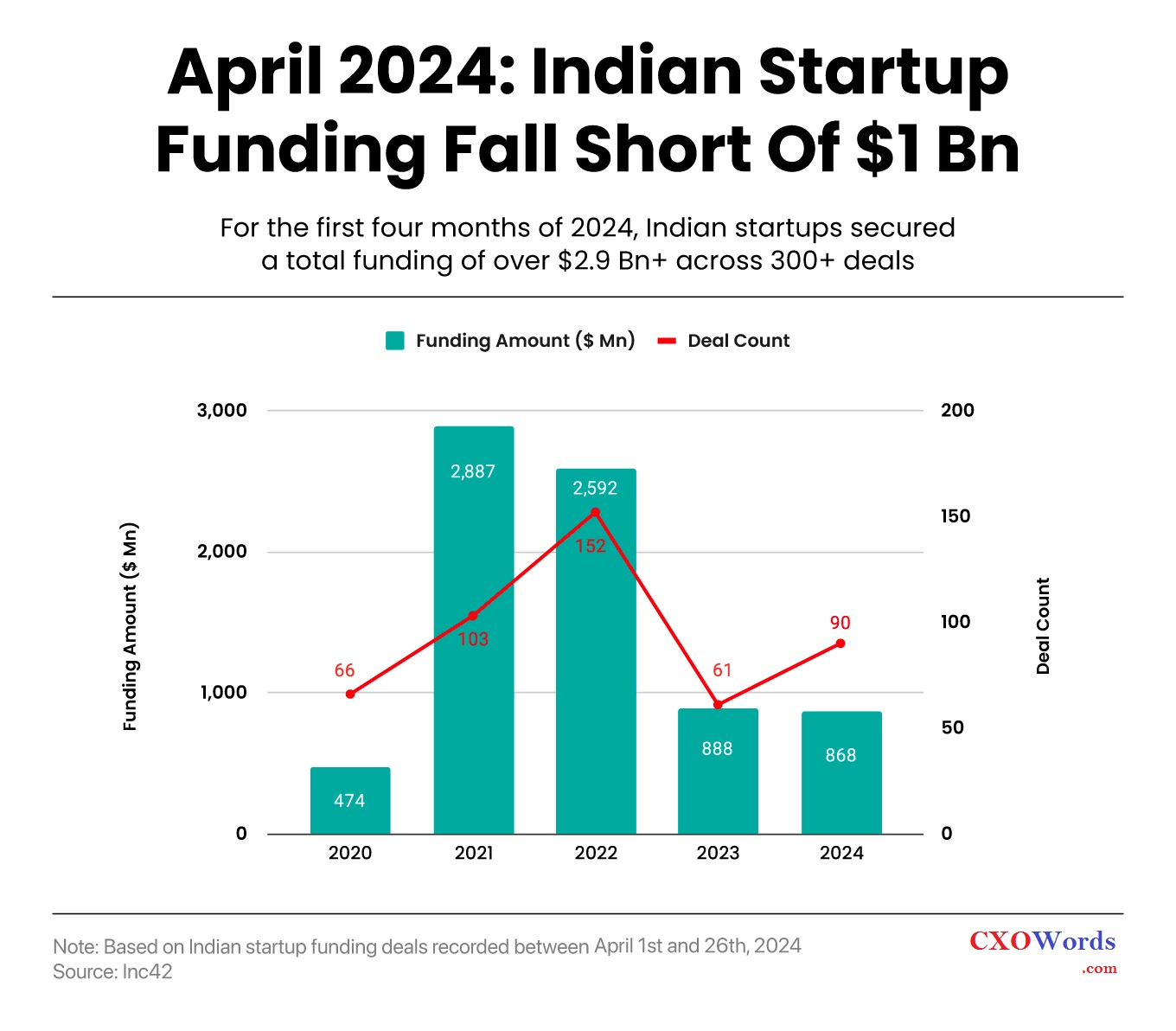

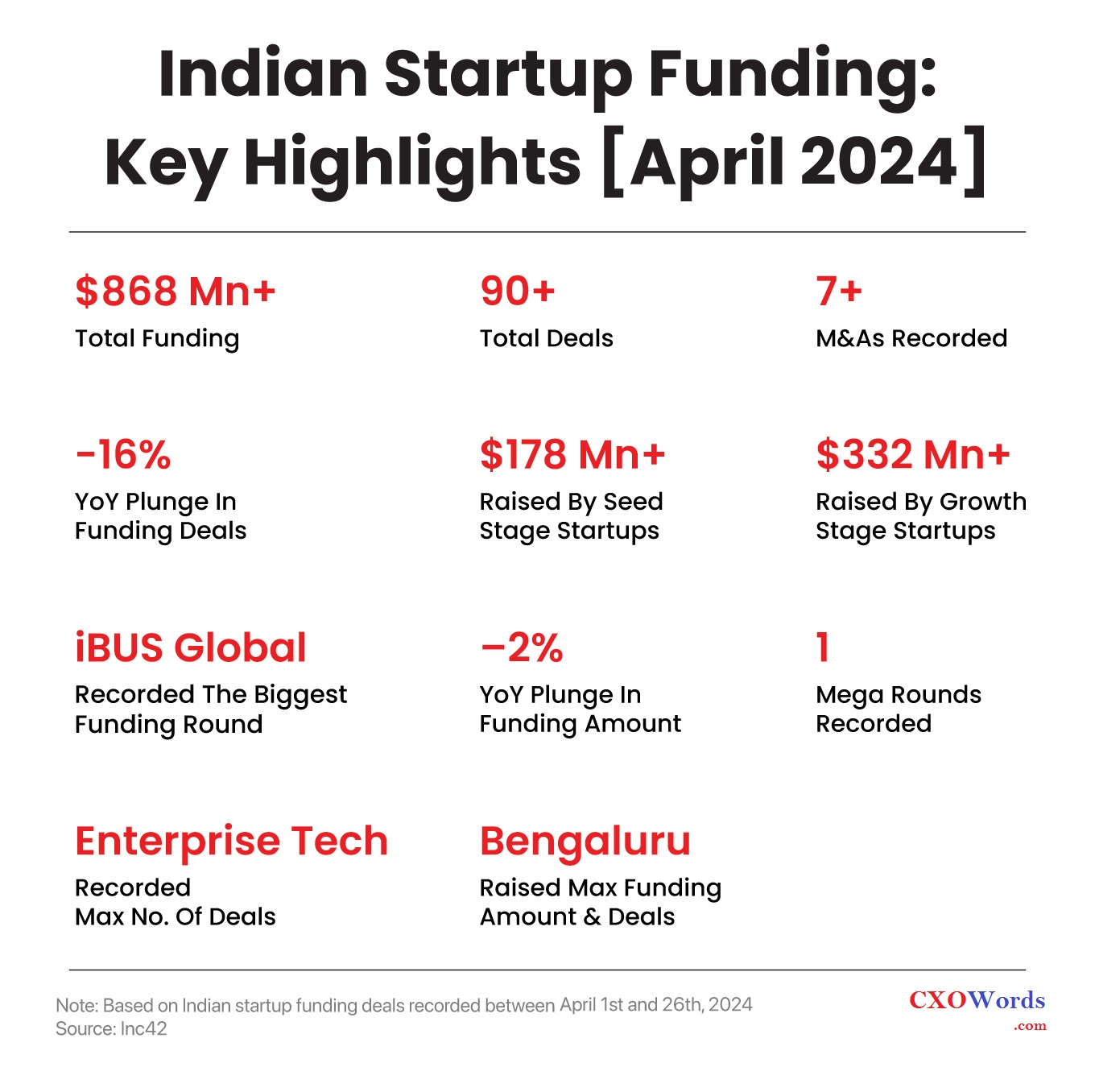

In April 2024, India witnessed a promising surge in startup funding, marking a significant turnaround from the challenges faced earlier in the year. During the period from April 1 to April 26, Indian startups collectively raised an impressive sum of $868 million, showcasing a robust 15% increase compared to the preceding month's figure of $754 million. This surge is particularly noteworthy given the backdrop of a five-year low of $512 million witnessed in January 2024.

The uptrend in funding was accompanied by a notable rise in deal count, with April 2024 recording a total of 90 deals, a substantial increase from the 63 deals concluded in March.

However, while the month-on-month increase is encouraging, it's essential to examine the year-on-year performance to gain a comprehensive understanding of the funding landscape. In this regard, April 2024's funding figure reflects a marginal 2% decline compared to the corresponding period in the previous year, which saw a total funding of $888 million. Moreover, there was a significant 66% decrease from the remarkable $1.52 billion raised by Indian startups in April 2022.

The breakdown of funding across different stages of startup growth provides valuable insights into the shifting dynamics of the ecosystem. Seed and growth stage startups experienced a notable year-on-year increase in funding during April, signaling renewed investor interest in early-stage ventures. Notably, seed stage startups secured $178 million across 46 deals, marking a substantial 286% increase from the $46 million raised in the same period last year.

The increase in seed funding was further fueled by significant investments in prominent startups. For instance, the new omnichannel fashion startup Lyskraft, founded by former Zomato senior executive Mohit Gupta and Myntra's founder Mukesh Bansal, received a substantial $26 million investment, contributing to the overall growth in seed stage funding.

Similarly, growth stage startups witnessed a robust 78% year-on-year increase, with total funding reaching $332 million in April 2024. Notable investments include iBUS, a digital infrastructure solutions company, which secured a significant $200 million in strategic funding from the National Investment and Infrastructure Fund (NIIF). Additionally, ProcMart, a growth stage enterprise tech startup, raised $30 million in a Series B funding round led by Fundamentum Partnership, co-founded by Nandan Nilekani and Sanjeev Aggarwal.

Despite the positive momentum observed in seed and growth stage funding, late-stage startups faced challenges, with funding plummeting by 50% compared to the previous year. Late-stage startups managed to raise only $314 million across 13 deals in April 2024, highlighting the need for strategic support and investor confidence in mature startups.

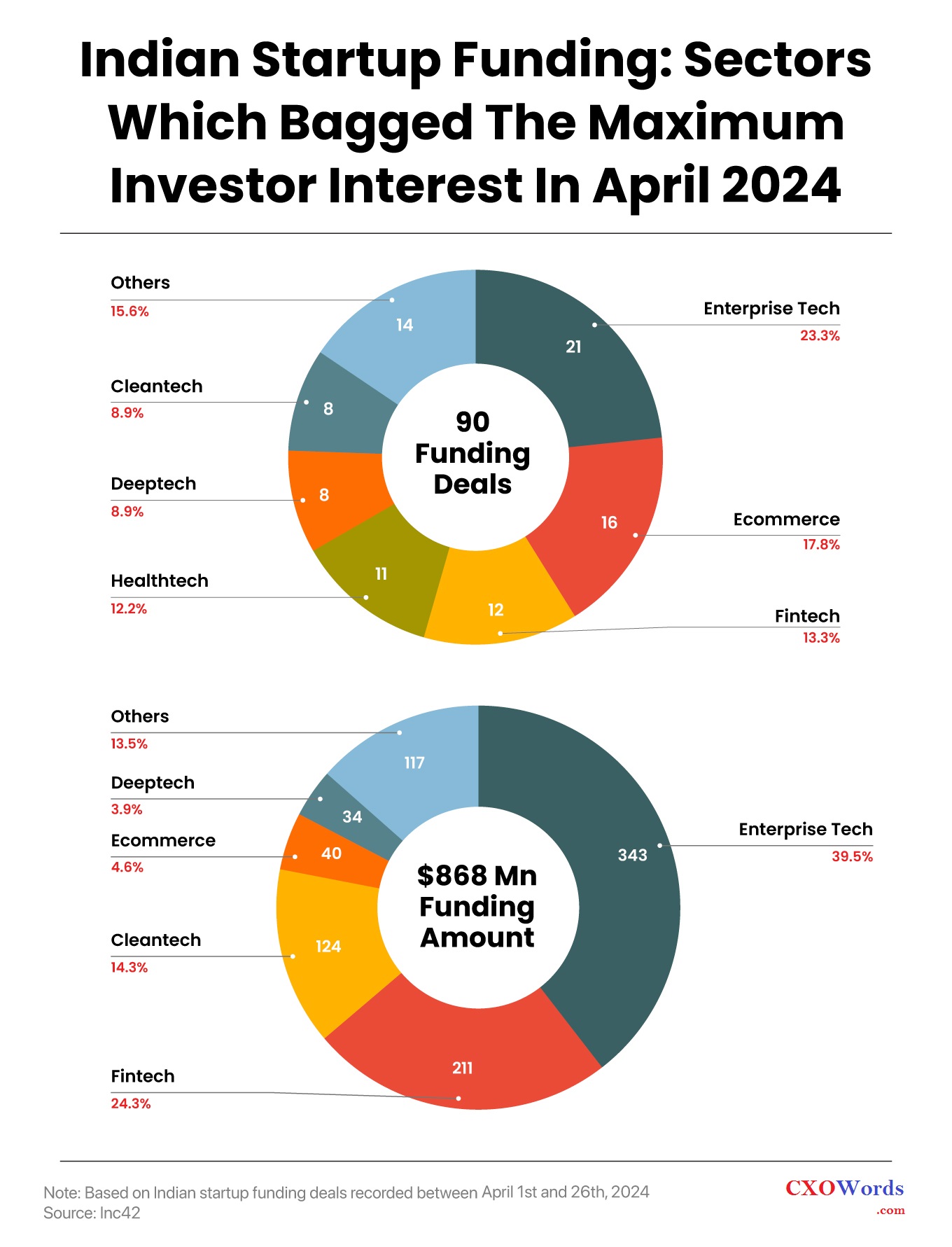

Furthermore, an analysis of sector-wise funding reveals interesting trends. The enterprise tech sector emerged as a frontrunner, attracting the highest funding in April 2024. Startups in this sector collectively secured $305 million across 21 deals, propelled by significant investments in innovative solutions. Meanwhile, the fintech sector, which led in the first quarter of 2024, slipped to the second position, with total funding of $211 million across 12 deals. Other sectors, such as cleantech, also witnessed notable investments, indicating diversification and innovation in the startup ecosystem.

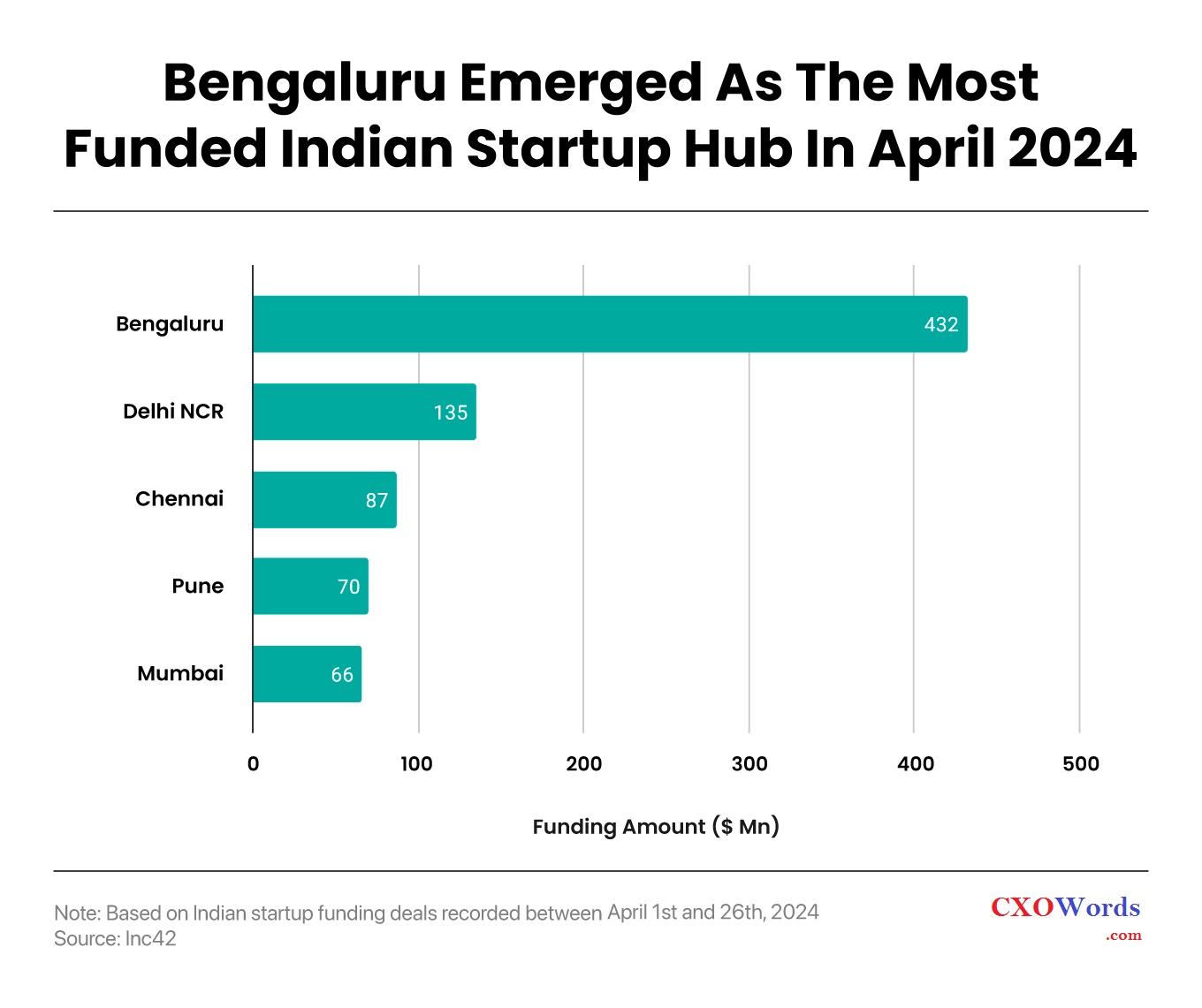

Geographically, Bengaluru continued to dominate as the preferred startup hub, with startups in the city securing $432 million across 28 deals in April 2024. Delhi NCR retained its position as the second-highest funded region, with total funding reaching $135 million. Interestingly, Chennai surpassed Mumbai to claim the third spot, with startups in the Tamil Nadu capital raising $87 million, while Mumbai secured $66 million in funding during the same period.

The surge in startup funding in April 2024 reflects resilience and optimism within the Indian startup ecosystem. While challenges persist, particularly in late-stage funding, the positive momentum observed across seed and growth stages bodes well for the future. As startups continue to innovate and scale, strategic investments and supportive policies will play a crucial role in sustaining growth and driving the next phase of evolution in India's startup landscape.